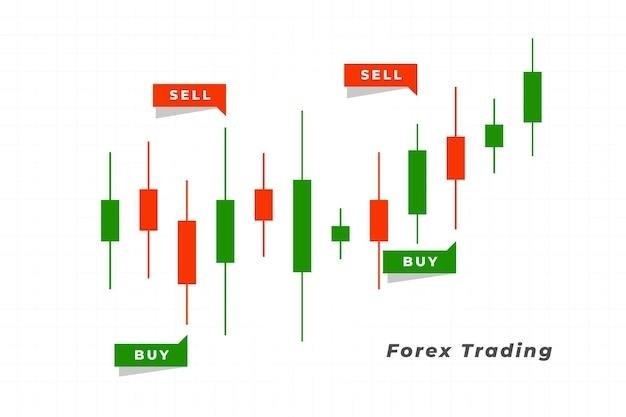

Bullish Reversal Candlestick Patterns⁚ A Comprehensive Guide

This guide explores bullish reversal candlestick patterns, crucial tools for identifying potential market shifts from downtrends to uptrends. Learn to spot key characteristics and interpret these patterns for profitable trading strategies. Mastering these patterns enhances your trading decision-making.

Bullish reversal candlestick patterns are powerful tools in technical analysis, signaling a potential shift from a bearish to a bullish market trend. These patterns emerge at the end of downtrends, indicating a possible change in market sentiment, from selling pressure to buying pressure. They are formed by specific candlestick combinations that visually represent a change in the balance of power between buyers and sellers. Understanding these patterns allows traders to anticipate potential price reversals and capitalize on emerging buying opportunities. The reliability of these patterns is enhanced when considered in conjunction with other technical indicators and supporting market context. While not foolproof predictors, mastering the identification and interpretation of these patterns significantly improves a trader’s ability to time market entries and exits effectively. Different patterns possess varying degrees of reliability, and proper risk management remains crucial. This section lays the groundwork for understanding the fundamental principles behind these patterns and their role in successful trading strategies.

Identifying Key Characteristics of Bullish Reversal Candlesticks

Recognizing key characteristics is crucial for accurate identification of bullish reversal candlestick patterns. These patterns often feature a significant shift in price action, contrasting with the preceding downtrend. Look for candlesticks with unusually long lower wicks (shadows) compared to their bodies, signaling buyers stepping in to absorb selling pressure near the lows. Conversely, short upper wicks suggest limited selling pressure at higher price points. The size and color of the candlestick bodies also provide valuable clues. A long, solid body indicates strong buying pressure, while a small body suggests indecision. The relationship between consecutive candlesticks is critical; a smaller candle following a large bearish candle can be a significant indicator. Pay close attention to the overall context of the chart, examining the preceding trend and volume. Increased volume accompanying a bullish reversal pattern enhances its significance, confirming increased buying interest. Analyzing these visual cues in combination provides a more comprehensive understanding and increases the reliability of identifying genuine reversal signals, minimizing the risk of false signals. Remember that confirmation from other technical indicators is always recommended.

Popular Bullish Reversal Patterns⁚ Hammer, Bullish Engulfing, Piercing Line

Several popular candlestick patterns reliably signal potential bullish reversals. The Hammer, a single-candlestick pattern, is characterized by a small real body at the top of the candlestick and a long lower wick, suggesting buyers stepped in to halt the downtrend near its lows. The Bullish Engulfing pattern involves two candlesticks⁚ a smaller bearish candle followed by a larger bullish candle that completely engulfs the previous one. This signifies a shift in momentum, with buyers overpowering sellers. The Piercing Line, another two-candlestick pattern, features a large bearish candle followed by a bullish candle that opens lower but closes above the midpoint of the preceding bearish candle. This suggests growing buyer dominance and a potential upward price movement. It’s crucial to remember that these patterns are more reliable when they appear after a significant downtrend and are accompanied by increased trading volume. While these patterns provide strong indications, they should not be relied upon in isolation. Combining them with other technical analysis tools and considering the broader market context is essential for making informed trading decisions. Contextual analysis and confirmation are key to successful trading using these patterns.

Understanding the Context of Bullish Reversal Patterns

While bullish reversal candlestick patterns offer valuable insights into potential price changes, their interpretation must always consider the broader market context. Analyzing these patterns in isolation can lead to inaccurate predictions and poor trading decisions. The overall market trend is a critical factor. A bullish reversal pattern appearing during a strong uptrend might simply be a minor correction, not a significant reversal. Conversely, the same pattern emerging after a prolonged downtrend carries much stronger weight, suggesting a potential shift in market sentiment. Volume analysis is equally important; a significant increase in trading volume accompanying a bullish reversal pattern strengthens the signal, indicating strong buyer conviction. Conversely, low volume suggests weak buying pressure, diminishing the reliability of the reversal signal. Consider the asset’s historical volatility. Highly volatile assets might exhibit frequent false signals, making the patterns less reliable. In contrast, less volatile assets might show more consistent results. Furthermore, understanding the prevailing economic conditions, news events, and overall market sentiment provides crucial context for evaluating the significance of any candlestick pattern. Successful traders integrate all these elements for a more accurate and comprehensive assessment of the market’s direction.

The Importance of Confirmation Signals

Relying solely on candlestick patterns for trading decisions is risky. Confirmation signals significantly increase the reliability of a bullish reversal prediction, reducing the likelihood of false signals and minimizing potential losses. One crucial confirmation is an increase in trading volume. A significant rise in volume accompanying a bullish reversal pattern validates the strength of the buying pressure, confirming the potential reversal. Conversely, low volume suggests weak buying interest, weakening the signal’s reliability. Technical indicators provide another layer of confirmation. Moving averages, Relative Strength Index (RSI), or MACD can reinforce the bullish signal if they show a clear upward trend or positive divergence. Support and resistance levels are critical. A bullish reversal pattern breaking through a significant resistance level adds substantial weight to the reversal prediction. Similarly, the pattern’s formation above a strong support level provides additional confirmation. Price action analysis should also be incorporated. Look for subsequent price movements confirming the upward trend. A sustained price increase after the pattern’s formation, coupled with higher highs and higher lows, strongly supports the bullish reversal. Finally, consider fundamental analysis. Positive news, strong earnings reports, or improving economic indicators can reinforce the bullish signal indicated by the candlestick pattern and the accompanying confirmation signals. Using multiple confirmation methods reduces risk and boosts confidence in your trading decisions.

Combining Candlestick Patterns with Other Indicators

While candlestick patterns offer valuable insights, combining them with other technical indicators enhances accuracy and reduces the risk of false signals. Moving averages, such as the 50-day and 200-day simple moving averages (SMAs), provide context for the pattern’s formation. A bullish reversal pattern appearing after a price decline below the 50-day SMA, followed by a break above it, strengthens the bullish signal. Momentum indicators like the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) can confirm the strength of the potential reversal. A bullish divergence, where the price makes lower lows but the RSI forms higher lows, suggests weakening selling pressure and growing buying interest, complementing a bullish candlestick pattern. Volume analysis plays a crucial role. Increased volume accompanying the bullish reversal pattern confirms the strength of the buying pressure, while low volume casts doubt on the signal’s reliability. Support and resistance levels provide additional context. A bullish reversal pattern breaking through a significant resistance level strengthens the signal, signifying a potential breakout. Fibonacci retracement levels can identify potential price targets for the upward move, adding another layer to the analysis. By combining candlestick patterns with these indicators, traders gain a more comprehensive understanding of market dynamics and improve the accuracy of their trading decisions, reducing the likelihood of entering trades based on false signals. This holistic approach significantly enhances the effectiveness of candlestick pattern analysis.

Risk Management and Trade Execution Strategies

Effective risk management is paramount when trading based on bullish reversal candlestick patterns. Never risk more capital than you can afford to lose. A common approach is to risk only 1-2% of your trading capital on any single trade. Determine your stop-loss order before entering the trade. This order automatically exits the position if the price moves against you, limiting potential losses. Place your stop-loss order below the low of the candlestick pattern or at a nearby support level. The target price, representing your profit objective, should be based on technical analysis, such as price targets derived from Fibonacci retracement levels or previous resistance levels. Consider using a trailing stop-loss order, which adjusts automatically as the price moves in your favor, locking in profits and protecting gains. Position sizing is crucial. Avoid over-leveraging your trades. Smaller position sizes reduce the impact of losing trades. Backtesting your strategy using historical data can help optimize your risk management approach and refine your trading plan. Maintain a trading journal to record your trades, noting the candlestick patterns, supporting indicators, risk management parameters, and outcomes. This meticulous approach aids in learning from both successful and unsuccessful trades, leading to improved decision-making and consistent risk management. Remember, even with careful planning, losses are an inherent part of trading. Disciplined risk management mitigates these losses and maximizes the potential for long-term success.

Advanced Bullish Reversal Patterns⁚ Island Reversal, Morning Star

Beyond the fundamental patterns, certain advanced formations offer strong bullish reversal signals. The Island Reversal, a powerful indicator, features a significant gap separating the candlestick pattern from preceding price action; This gap signifies a decisive shift in market sentiment. A bullish island reversal involves a gap down followed by a strong upward movement, creating a distinct “island” on the chart. Confirmation is crucial; look for increased trading volume accompanying the price surge. The Morning Star pattern presents a three-candlestick formation. It begins with a long bearish candle, followed by a small indecisive candle (often a doji), and concludes with a strong bullish candle. This pattern suggests a potential bottoming out, with the indecisive candle representing a pause before the bullish reversal. The Morning Star’s reliability increases with higher trading volume on the final bullish candle. Both patterns require careful interpretation within the broader market context. Consider factors such as overall trend, support and resistance levels, and volume changes when assessing these advanced formations. False signals can occur; therefore, combining these patterns with other technical indicators and confirming signals can significantly improve accuracy. Remember that confirmation is key to avoid misinterpretations and minimize trading risks associated with these advanced reversal patterns. Thorough understanding and cautious application are vital for success.

Interpreting Bullish Reversal Patterns in Different Market Conditions

The effectiveness of bullish reversal patterns can vary significantly depending on the prevailing market conditions. In strong uptrends, these patterns might be less reliable, as the overall market momentum might override the reversal signal. Conversely, during sideways or consolidating markets, these patterns can offer more accurate predictions, as the price action is less influenced by strong directional trends. Bearish markets present a unique challenge. While a bullish reversal pattern might signal a temporary price bounce, it’s crucial to differentiate between a genuine reversal and a mere temporary respite within a larger downtrend. The volume associated with the candlestick pattern is a key factor. High volume accompanying the reversal suggests strong conviction from buyers, increasing the likelihood of a sustained uptrend. Low volume, however, can indicate weak buying pressure, suggesting the reversal might be short-lived. Furthermore, the context of the pattern within the larger timeframe is vital. A bullish reversal pattern on a daily chart might hold more weight than the same pattern on an hourly chart. It is also important to consider other technical indicators alongside the candlestick patterns for confirmation before making trading decisions. By carefully analyzing the market context alongside the pattern itself, traders can greatly improve the accuracy of their interpretations and reduce the risk of false signals.

Practical Applications and Case Studies

Let’s examine real-world examples illustrating the practical application of bullish reversal patterns. Consider a stock experiencing a consistent downtrend. The appearance of a hammer candlestick pattern at the end of this downtrend, coupled with increased trading volume, could signal a potential buying opportunity. A trader might enter a long position, anticipating a price increase. However, this decision shouldn’t be solely based on the candlestick pattern. Confirmation from other indicators, such as moving averages or RSI, would strengthen the trading signal. Conversely, a piercing line pattern emerging during a downtrend suggests a shift in market sentiment. The pattern’s formation, where the second candle engulfs a portion of the first, signifies growing buyer influence. A trader might use this pattern as a trigger to initiate a long position, but only after confirming the signal with other technical indicators and risk management strategies. Successful use of these patterns depends on understanding their context. A bullish engulfing pattern in a volatile market might be less reliable than one in a calmer market. Analyzing historical chart data for specific stocks or indices allows for backtesting strategies incorporating these patterns. By documenting the results of trading decisions based on these patterns under various market conditions, one can refine their approach and improve trading performance; The key is disciplined observation, confirmation with other indicators, and prudent risk management.

Mastering Bullish Reversal Candlestick Patterns for Profitable Trading

Bullish reversal candlestick patterns offer valuable insights into potential market reversals, but they are not foolproof predictors. Successful trading hinges on a comprehensive approach that combines pattern recognition with other technical analysis tools and a robust risk management strategy. While patterns like the hammer, bullish engulfing, and piercing line provide strong indicators, confirmation from supporting indicators is crucial. Relying solely on candlestick patterns can lead to false signals and losses. Therefore, incorporating moving averages, relative strength index (RSI), or volume analysis adds layers of confirmation, increasing the reliability of trading decisions. Furthermore, understanding the broader market context is paramount. A bullish reversal pattern might be less effective during periods of significant economic uncertainty or geopolitical instability. Effective risk management, including setting stop-loss orders and position sizing, is essential to protect capital and limit potential losses. Continuous learning and practice are key to mastering the interpretation and application of these patterns. By combining theoretical knowledge with real-world experience, traders can refine their skills and improve their chances of profitable trading based on bullish reversal candlestick signals. Remember, consistent monitoring, adaptation, and a disciplined approach are crucial for long-term success.